Category:Green Business: Difference between revisions

Siterunner (talk | contribs) No edit summary |

Siterunner (talk | contribs) No edit summary |

||

| Line 4: | Line 4: | ||

: | ::''Now is the time to go beyond old ways of thinking, shaping new visions of our communities and our living home -- Planet Earth.'' | ||

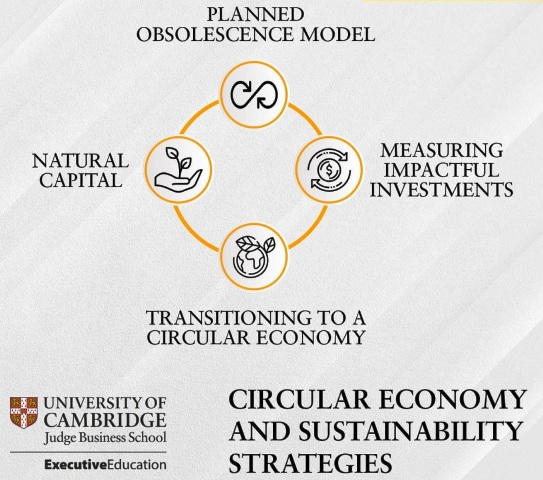

::Clean & Renewable, Not Energy Inefficient, Not Wasteful, Moving Past Planned Obsolesence | |||

<big>The 26th UN Climate Change Conference of the Parties (COP26) in Glasgow on 31 October - 12 November 2021</big> | |||

* https://ukcop26.org/ | |||

[[File:COP26 in GLASGOW - 31 OCT-12 NOV 2021.jpg]] | |||

| |||

:::[https://www.youtube.com/watch?v=FG0fTKAqZ5g&feature=youtu.be <small>'''''Our Home Planet'''''</small>] | |||

:::[[File:Earth day 2016.jpg|link=http://www.planetcitizens.org]] | |||

| |||

:::<big><big>[[Face the Climate Crisis - Now]]</big></big> | |||

:::: <big><font color=green>'''#ActNow, Before It's Too Late'''</font></big> | |||

October 26, 2021 | |||

<big>'''''Al Gore launches climate change asset manager'''''</big> | |||

* https://todayuknews.com/market/al-gore-launches-climate-change-asset-manager/ | |||

'''''“Business as usual won’t get us to cut emissions in half in the next nine years.”''''' | |||

''Al Gore, former US vice-president, and financier David Blood have set up a new asset manager that they say will turn the traditional investment model “on its head” by prioritising tackling climate change over short-term financial returns.'' | |||

'''''Just Climate''''', ''which launches on Wednesday with a mandate to invest in solutions that will help to limit global temperature rises to 1.5C, has already won the backing of Microsoft, Ireland’s sovereign wealth fund and a foundation linked to flat-pack retailer Ikea.'' | |||

''David Blood, the former head of Goldman Sachs Asset Management, said the new investment house would focus largely on private markets, taking a long-term approach to investing by backing projects and companies for periods of up to 15 years across energy, transport, building, agriculture and other industries.'' | |||

''The launch comes as the investment industry is under increasing pressure to play a bigger role in the transition to a low-carbon economy, with critics arguing the sector is not doing enough to finance climate solutions or use its power as shareholders to police fossil fuel producers.'' | |||

''Blood, who set up sustainable asset manager Generation Investment Management with Gore almost two decades ago, said there was a need for capital markets to change how it values investments by put putting more focus on the impact.'' | |||

''“By not prioritising the impact, we are not moving fast enough [to tackle climate change],” he said. “Business as usual won’t get us to cut emissions in half in the next nine years.”'' | |||

More: | |||

<big>''' ‘Capitalism is in danger of falling apart’ '''</big> | |||

''“Now is a crucial moment for investors, he continues. “The next five to 10 years is the most critical time to accelerate the transition to a low-carbon economy. We think capitalism is in danger of falling apart. As a result, the business, which has been fairly reticent in the past about the mechanics of investing sustainably, is planning to increase its visibility. ‘We need to go all in. We are going to be more aggressive because we have to.'” — Blood and Gore: “Capitalism is in Danger of Falling Apart”, Financial Times, July 27, 2014 | |||

'''''Pension Funds Announce New Investment Strategies'''''' | |||

''From a September 8, 2015 article “David Blood and Al Gore Want to Reach the Next Generation” published by Institutional Investor'' | |||

''"The California State Teachers’ Retirement System [CalSTRS], the second-largest public pension fund in the U.S., with $191 billion in assets, was the first American institutional investor to invest in Generation.” | |||

''This was part of an oil/gas divestment campaign led by Ceres partner 350.org ... Jack Ehnes, CEO of CalSTRS, also serves on the board of Ceres.'' | |||

In 2018, the Generation Investment fund reported progress in an April article - ''Al Gore: Sustainability is History's Biggest Investment Opportunity - published in the Financial Times | |||

''“Generation lists large public sector investors among its clients, such as Calstrs, the $223bn Californian teachers’ pension plan, the $192bn New York State pension plan and the UK’s Environment Agency retirement fund. It also manages money for wealthy individuals but has stopped short of opening to retail investors. Almost all its assets are run in equity mandates, yet $1bn is invested in private equity.”'' | |||

''... (with) two investment funds – Global Equity and Asia Equity. The Global Equity fund is currently closed – there is a multi-year waiting list that is also currently closed. The minimum investment is $1 million and you need to be super-accredited. The fund seems to be targeted at institutional investors – not individuals. The Asia Equity fund is open but the same minimum requirements apply ($1M minimum).”'' | |||

···················································································· | |||

<big>'''Designing & Building a Smart, Sustainable Future'''</big> | |||

:Clean & Renewable, Not Energy Inefficient, Not Wasteful, Moving Past Planned Obsolesence | |||

Revision as of 15:13, 27 October 2021

<addthis />

- Now is the time to go beyond old ways of thinking, shaping new visions of our communities and our living home -- Planet Earth.

The 26th UN Climate Change Conference of the Parties (COP26) in Glasgow on 31 October - 12 November 2021

- #ActNow, Before It's Too Late

October 26, 2021

Al Gore launches climate change asset manager

“Business as usual won’t get us to cut emissions in half in the next nine years.”

Al Gore, former US vice-president, and financier David Blood have set up a new asset manager that they say will turn the traditional investment model “on its head” by prioritising tackling climate change over short-term financial returns.

Just Climate, which launches on Wednesday with a mandate to invest in solutions that will help to limit global temperature rises to 1.5C, has already won the backing of Microsoft, Ireland’s sovereign wealth fund and a foundation linked to flat-pack retailer Ikea.

David Blood, the former head of Goldman Sachs Asset Management, said the new investment house would focus largely on private markets, taking a long-term approach to investing by backing projects and companies for periods of up to 15 years across energy, transport, building, agriculture and other industries.

The launch comes as the investment industry is under increasing pressure to play a bigger role in the transition to a low-carbon economy, with critics arguing the sector is not doing enough to finance climate solutions or use its power as shareholders to police fossil fuel producers.

Blood, who set up sustainable asset manager Generation Investment Management with Gore almost two decades ago, said there was a need for capital markets to change how it values investments by put putting more focus on the impact.

“By not prioritising the impact, we are not moving fast enough [to tackle climate change],” he said. “Business as usual won’t get us to cut emissions in half in the next nine years.”

More:

‘Capitalism is in danger of falling apart’

“Now is a crucial moment for investors, he continues. “The next five to 10 years is the most critical time to accelerate the transition to a low-carbon economy. We think capitalism is in danger of falling apart. As a result, the business, which has been fairly reticent in the past about the mechanics of investing sustainably, is planning to increase its visibility. ‘We need to go all in. We are going to be more aggressive because we have to.'” — Blood and Gore: “Capitalism is in Danger of Falling Apart”, Financial Times, July 27, 2014

Pension Funds Announce New Investment Strategies'

From a September 8, 2015 article “David Blood and Al Gore Want to Reach the Next Generation” published by Institutional Investor

"The California State Teachers’ Retirement System [CalSTRS], the second-largest public pension fund in the U.S., with $191 billion in assets, was the first American institutional investor to invest in Generation.”

This was part of an oil/gas divestment campaign led by Ceres partner 350.org ... Jack Ehnes, CEO of CalSTRS, also serves on the board of Ceres.

In 2018, the Generation Investment fund reported progress in an April article - Al Gore: Sustainability is History's Biggest Investment Opportunity - published in the Financial Times

“Generation lists large public sector investors among its clients, such as Calstrs, the $223bn Californian teachers’ pension plan, the $192bn New York State pension plan and the UK’s Environment Agency retirement fund. It also manages money for wealthy individuals but has stopped short of opening to retail investors. Almost all its assets are run in equity mandates, yet $1bn is invested in private equity.”

... (with) two investment funds – Global Equity and Asia Equity. The Global Equity fund is currently closed – there is a multi-year waiting list that is also currently closed. The minimum investment is $1 million and you need to be super-accredited. The fund seems to be targeted at institutional investors – not individuals. The Asia Equity fund is open but the same minimum requirements apply ($1M minimum).”

····················································································

Designing & Building a Smart, Sustainable Future

- Clean & Renewable, Not Energy Inefficient, Not Wasteful, Moving Past Planned Obsolesence

Green Products @Home and @Work

Going green, making a positive difference

- No 'Greenwashing' allowed

○

GreenPolicy360: Advocating for Diversified Business with Green Values and Goals

Every Business, Every Supply Chain

Are you thinking and acting to make your supply chain green?

Be Climate Resilient

A company is only as good — and as protected — as its suppliers.

Forward-looking companies are engaging suppliers around health, safety, and environmental issues,

The Sustainability Initiative at MIT Sloan teaches changes that improve supply chain partners’ climate resilience...

○

Consider the Hannover Principles of Design

Review McDonough's "Design, Ecology, Ethics and the Making of Things", a "Centennial Sermon" delivered in the Cathedral of St. John the Divine , NYC, February 7, 1993

"Cradle-to-cradle" design ... developing green principles of sustainable practices "affirming life" on our home planet, envisiong green eco-nomics.

○

- Business and Investing for sustainable economics, social & progressive causes

- Business for Social Responsibility -- https://www.bsr.org/

- Social Venture Network -- http://svn.org/

○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○

○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○

"New Economics", Concepts and Strategies

Communities and companies, non-profit and for-profit

Green Best Practices -- Smart Growth

Small-, medium- and large-businesses (SMBs)

Navigating through tides and all seas, winds and calm, storms and fair running

Changing, Competing, Charting a Successful Course

Venturing into a Sustainable Future

Acting with Short-term Objectives and Acting for the Common, Long-term Good

Envisioning "The Commons"

- Out-in-Front Politics

New Economics, People and the Planet

Sojourner: Reclaiming the Commons

○

Democracy Collaborative

Next System Project

○

Community-wealth generation focus:

- ○

Community business strategies:

~

Subcategories

This category has the following 21 subcategories, out of 21 total.

Pages in category "Green Business"

The following 65 pages are in this category, out of 65 total.

B

G

K

M

S

- Sacramento County, CA Sustainable Business Program

- Salt Lake City, UT e2 Business Program

- San Diego County, CA Green Business Program

- San Francisco, CA Green Business Program

- San Francisco, CA Municipal Code Pertaining to Green Business Program

- San Mateo County, CA Green Business Program

- Seed Saving

- Sharing Economy

- Stakeholder Theory

- Stuff

- Sustainable Development

W

Media in category "Green Business"

The following 146 files are in this category, out of 146 total.

- Acting to make a positive difference - in St Petersburg Florida.png 600 × 723; 645 KB

- Al-gore-future.jpg 586 × 390; 40 KB

- American Jobs Act compared w THRIVE Act (Green New Deal).jpg 674 × 798; 90 KB

- AOC March 26, 2019.jpg 597 × 433; 58 KB

- ARPAE - energy innovation.jpg 693 × 461; 215 KB

- Aspen Trees Fall Colors Web-of-Roots Connected Wiki commons.jpg 800 × 533; 171 KB

- B Corporations certlogo.png 274 × 388; 14 KB

- Be kind-2.jpg 250 × 164; 20 KB

- Biggest climate related legislation in history - 1.png 800 × 188; 68 KB

- Bioneers 2023 - ThirdAct.Org.jpg 624 × 600; 145 KB

- Bioneers conf 2016.png 700 × 499; 1.03 MB

- Bioneers Conf 2021- Buckminster Fuller Instit joins.png 469 × 586; 599 KB

- Bioneers conference 2018-o.jpg 800 × 400; 134 KB

- Bioneers conference 2019 - 30 years anniv.jpg 800 × 400; 129 KB

- Bioneers It's all connected - 30th annual conference.jpg 527 × 521; 79 KB

- Bioneers-Hawken-Being Fierce and Fearless.jpg 751 × 685; 130 KB

- Bloomberg Carbon Clock 10-26-2021 8-47-05 AM EST.png 800 × 195; 356 KB

- Brazil INDC 2015.png 592 × 366; 301 KB

- Carbon Brief - Greenhouse gas levels 2021.png 640 × 436; 292 KB

- Carbon Footprint - BP-McKibben-Solnit-Aug2021.jpg 516 × 264; 66 KB

- Carbon-footprint small or large.jpg 149 × 258; 0 bytes

- Carbon-footprint.jpg 297 × 516; 59 KB

- Caroline Lucas-Green New Deal.jpg 584 × 391; 71 KB

- Catching the sun film.jpg 705 × 988; 366 KB

- Cause-related M Channel.jpg 700 × 531; 45 KB

- Challenge of Acting for the Commons.png 700 × 548; 175 KB

- Chile's electric bus fleet.jpg 543 × 541; 74 KB

- Circular Economy - Sustainable Strategies.png 543 × 480; 328 KB

- Climate action isn't 'bunny hugging' says Boris.jpg 800 × 264; 95 KB

- Climate Change and Insurance.png 247 × 82; 27 KB

- Climate Plan pledges as Oct6,2015.png 529 × 409; 101 KB

- Climate-Action-Plan-World Bank-2016.png 780 × 6,050; 3.2 MB

- Co-operative Enterprises ica.coop.png 704 × 339; 173 KB

- Common Ground, the Movie.png 600 × 756; 775 KB

- Commons-concepts permanent culture now s.png 448 × 211; 75 KB

- Commons-concepts permanent culture now.png 830 × 391; 39 KB

- Conversation prism.jpeg 561 × 600; 0 bytes

- Cradle to Cradle Products Innovation Instit.jpg 600 × 600; 72 KB

- Digital.png 427 × 116; 51 KB

- Drawdown - pushing climate action at work 2.png 640 × 955; 315 KB

- Drawdown - pushing climate action at work.png 632 × 777; 585 KB

- Drawdown Climate action, climate solutions.png 800 × 695; 246 KB

- Drawdown CO2 - Online Education solutions video.jpg 800 × 443; 124 KB

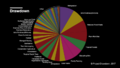

- Drawdown Solution Chart.png 800 × 450; 186 KB

- Drawdown.jpg 352 × 450; 53 KB

- Earth Day Flag.png 400 × 267; 69 KB

- Eco-labels.jpg 468 × 351; 68 KB

- ECOTRAM - Don Perry.png 800 × 474; 390 KB

- Electric busses-China.png 492 × 569; 277 KB

- Environmental Protection Agency logo.png 380 × 414; 39 KB

- EPA and the Green Bank - Feb 2023.png 476 × 542; 244 KB

- ERoadArlanda.png 800 × 495; 539 KB

- Escape from affluenza.gif 265 × 216; 15 KB

- EV charging stations news, US circa Feb 2022.jpg 629 × 480; 101 KB

- EV charging stations, US circa Feb 2022.jpg 519 × 480; 78 KB

- Fact Sheet-The American Jobs Plan.jpg 640 × 122; 16 KB

- Ford and Tesla make EV charging deal.jpg 336 × 419; 117 KB

- Gcf blgrnlogorgb.jpg 500 × 334; 50 KB

- Global fossil fuel emissions - in a lifetime graphic.png 600 × 657; 233 KB

- Global Green New Deal.jpg 427 × 640; 32 KB

- GND sign at capitol resolution announce.png 445 × 177; 96 KB

- Going Green 2019.jpg 800 × 356; 15 KB

- Gp360 logo.png 132 × 36; 4 KB

- Green Collar Economy.jpg 100 × 160; 6 KB

- Green High Five.png 406 × 146; 22 KB

- Green Marketing tag cloud 3.png 819 × 406; 128 KB

- Green New Deal - Bloomberg Jan 29,2019.png 640 × 757; 589 KB

- Green New Deal - Resolution.pdf ; 55 KB

- Green New Deal - Strategic Demands - Oct 1, 2021.png 602 × 658; 245 KB

- Green Wave.png 613 × 405; 427 KB

- Green-marketing 3.png 196 × 84; 10 KB

- Green-New-Deal-December-2018-1.png 800 × 634; 207 KB

- GreenBiz Drawdown story cover.png 888 × 712; 394 KB

- Greenhouse gas levels hit record - Reuters.jpg 600 × 696; 104 KB

- GreenLinks logo - 2.png 451 × 84; 13 KB

- GreenLinks logo.png 644 × 120; 10 KB

- GreenPolicy tag cloud m.png 450 × 223; 74 KB

- Image3.png 196 × 30; 2 KB

- It's a good day for a sunflower pic.png 520 × 553; 0 bytes

- Laudato Si On Care for Our Common Home.png 546 × 577; 108 KB

- Leonardo and Greta Nov 1, 2019.jpg 587 × 438; 60 KB

- Linked.jpg 316 × 475; 36 KB

- M Channel Envisioning the Future 4.png 700 × 845; 246 KB

- Manchin again - July 15 2022.png 600 × 654; 523 KB

- Map of the World wiki commons GTN800x370.png 800 × 370; 39 KB

- Mobile Development Impact GSMA as of 2015.png 823 × 839; 269 KB

- Mobile subscriptions outnumber world population 2015.jpg 599 × 427; 37 KB

- Naomi Klein speaking at the Bioneers conf.png 700 × 429; 385 KB

- Organic-chart-Jan-2016.pdf ; 136 KB

- Overshoot presentation - Rees 2.png 640 × 246; 81 KB

- Overshoot presentation by Prof William Rees - 2021.jpg 640 × 432; 76 KB

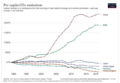

- Per capita CO2 emissions - to 2020.png 640 × 442; 153 KB

- Permaculture-observation tip.jpg 480 × 540; 86 KB

- Piece of a Protoplanet.jpg 632 × 600; 69 KB

- Planet Citizen green energy.JPG 720 × 480; 99 KB

- Planetcitizens-336x336.png 336 × 336; 206 KB

- Project Drawdown - Spring 2021.jpg 570 × 471; 85 KB

- Project Drawdown with Matt Scott - On Earth Day 2022.png 728 × 600; 224 KB

- Project Drawdown.jpg 400 × 437; 99 KB

- Rebuild the Dream.jpg 100 × 160; 6 KB

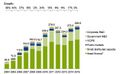

- Renewable Energy investment growth chart 2004-2014.jpg 600 × 368; 31 KB

- Renewable Potential US-Utility Scale PV.png 660 × 514; 57 KB

- Social Media icons free.png 650 × 270; 281 KB

- Social media icons.jpg 510 × 394; 64 KB

- Steven J Schmidt, May 2023.png 363 × 484; 383 KB

- Suburu Solterra - 2023.png 640 × 327; 541 KB

- Surprise climate deal.png 589 × 735; 83 KB

- Swap n Go Battery Time.jpg 460 × 302; 42 KB

- Tesla Freight Trucks - 2018.jpg 628 × 480; 50 KB

- There is no plan B because....png 575 × 308; 115 KB

- There is no Planet B (vimeo-2015).png 623 × 337; 80 KB

- ThereIsNoPlanetB.png 589 × 174; 181 KB

- Timelapse in Google Earth -1.jpg 800 × 241; 69 KB

- Timelapse in Google Earth-2.jpg 800 × 469; 151 KB

- Timelapse in Google Earth-3.jpg 372 × 556; 52 KB

- Timelapse in Google Earth-4.jpg 525 × 244; 51 KB

- Timelapse in Google Earth-5.jpg 800 × 528; 124 KB

- To be fully alive is to work for the common good.png 612 × 819; 621 KB

- To serve - from Chef José Andrés.png 600 × 798; 535 KB

- UN Climate Conf Dec2015.png 576 × 182; 42 KB

- UN DecinParis.png 296 × 277; 135 KB

- UNFCCC 21-logo.jpg 720 × 300; 17 KB

- Water Risk Projects.jpg 1,140 × 518; 124 KB

- Water Risk WWF2011.pdf ; 4.28 MB

- Water stress by country.png 2,159 × 1,115; 584 KB

- We Mean Business on Climate Change 2015.png 424 × 762; 136 KB

- Wetlands - Wetlands Day.png 640 × 492; 333 KB

- Who really invented the climate stripes - Climate Change Education.png 600 × 600; 234 KB

- Whole Earth Catalog-Internet Archive-4-23-2021.jpg 592 × 305; 48 KB

- Wiki IPCC m.jpg 602 × 339; 112 KB

- World Bank Group Climate Action Plan Apr2016.png 522 × 729; 244 KB

- World Bank Group Climate Change Action Plan 2016.png 512 × 256; 167 KB

- WorldBank GreenBondFactsheet.pdf ; 196 KB

- Youth vote estimates 2016 primary.png 800 × 490; 257 KB

- Topic

- Air Quality

- Alternative Agriculture

- Aquifers

- Atmosphere

- City-County Governments

- Civil Rights

- Clean Water

- Climate Policy

- Earth

- Earth Science

- Eco-nomics

- Ecology Studies

- Economic Development

- Economics

- Environmental Protection

- Environmental Security

- Food

- Green Best Practices

- Green Banking

- Green Infrastructure

- Green Politics

- Green Values

- Human Rights

- Initiatives

- Labor Issues

- Natural Resources

- Natural Rights

- Networking

- New Economy

- Oceans

- Renewable Energy

- Resilience

- Rights of Nature

- Sustainability

- Sustainability Policies

- Toxics and Pollution

- Workers Rights